One of the great things about SPACs is the ability to redeem common shares for cash right before a merger as a failsafe. But retail traders don’t really understand how it works. Retail traders lost hundreds of thousands on CCXX because they didn’t understand how it worked.

How to redeem for cash:

You should get a notice from your broker

The tender offer gives you an estimated price to change your shares for cash. For CCXX the estimate was $10.04 per share. (Actual payout was $10.028/share)

To accept it, call your broker and let them know you want to accept the offer.

ONLY accept the offer if the common share price is below the tender price Otherwise you should sell in the market

Redeem the offer at the latest time possible, in-case the market price rises above the offering.

For Units, you should split them early since it may take a couple of days to split, or just sell in the open market.

What happens after:

Your account will have the CCXX shares removed, and a tender security in it’s place. (This might take a day of lag to update)

Cash will be deposited 2-3 business days after the merger vote!

My experience

10/5 9AM EST: I called Fidelity to accept the tender, and they accepted it

10/6 Replaced my CCXX common with a tender security

10/9 Funds deposited in my account (At $10.028 per share)

So why did retail trader lose thousands? They got the last day of accepting the offer wrong.

What happened?

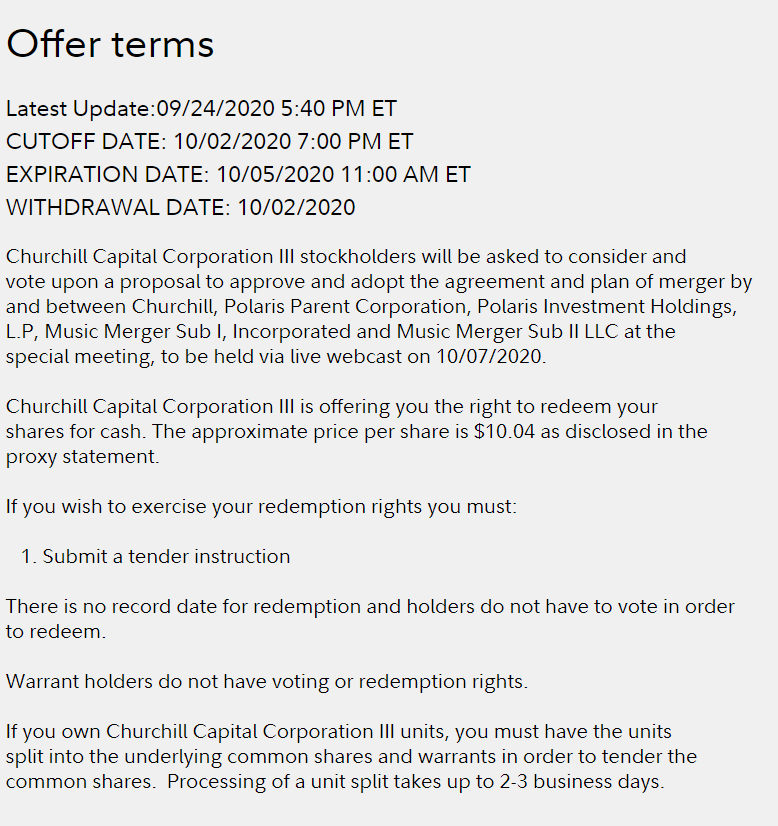

A lot of retail investors thought the last day to redeem their common shares for cash was 10/2, the cutoff date.

The actual last day was the expiration date, on 10/5 11AM EST. On the last day of the offer, while the offer was still valid, the stock sold off to as low as ~$9.00, way below the redemption amount $10.02. Retail traders were panic selling their shares and losing hundreds of thousands when they could have just redeemed them for $10.02

The confusion was because many alerts only mentioned the cutoff date. But not the “expiration date”. The actual last day to redeem was 10/05 11AM ET, not 10/02. I called Fidelity to redeem when CCXX was at $~9 on 10/05!

This is also potentially a huge arbitrage opportunity because there is no record date.

What’s the difference between ‘cutoff date’ and ‘expiration date’?

Technically the cutoff date is the last date your broker can guarantee your instruction is accepted. However you can submit anytime before the expiration. I called fidelity after the cut-off, and they said the only reason it wouldn’t be accepted is if there was a “power outage” at the broker’s office.

So there you have it! Hopefully this gives you more clarity in how to redeem your shares for cash, and some of the nuances to help you maximize your efforts.

If this helped you, please share with other and follow me.

Hi - in the off chance you see this, I was wondering if you knew what date you actually purchased the SPAC shares on? It seems like you purchased them after the cutoff date but obviously before the expiration, but just wanted to confirm. I came across a SPAC in the exact same situation but in my case Fidelity's cutoff was last Friday (10/21) and the expiration is EOD Monday (10/24), and I do not yet own any shares. Since the timing felt a bit tight and I really didn't want to get stuck with rollover shares, prior to buying any shares I called Fidelity to see if they thought the order could get submitted prior to expiration if I purchased the shares while the markets closed/in pre-market (giving the Fidelity people all day Monday to process the order). They said, somewhat vaguely, I probably wouldn't be able to get the order through in time. But now I'm wondering if the response would have been different if I owned the shares already, as you did. I guess what I'm asking is, was your purchase timing comparable to mine or did you buy your shares somewhat earlier? Thanks!

Hi Ji, hope you are well. Who qualifies for the redemption? Is it all common shareholders? ie. I did not purchase IPO shares and purchased in secondary. Would I still qualify for redemption rights? Or is this a case by case situation and need to dig deeper into filings?